Digital Twins Drive Geospatial Market Growth

Unveiling the Findings from the Annual Industry Survey

The ever-increasing use of digital twins in infrastructure and construction projects is creating a huge need for 3D geodata, which in turn is driving strong growth in our industry. That is just one conclusion we can draw from the most recent ‘GIM International’ annual industry survey. As the geomatics landscape continues to evolve and diversify, many providers of mapping and surveying solutions are focusing on specific vertical markets, ranging from agriculture, forestry and archaeology to construction, mining and civil engineering. Read on for our analysis of the survey results, in which we identify key growth opportunities and highlight which new mapping technology and solutions users are most likely to invest in over the coming months.

The term ‘geomatics’ – also known as geospatial surveying – encompasses a broad range of disciplines, including photogrammetry, remote sensing, land surveying, GIS and GNSS, as well as areas of experience such as Lidar, location-based services, cartography and image processing. But where are these disciplines used? In other words, in which sectors are our survey participants active? Most of the respondents (68.9%) indicate they are involved in land surveying, followed at a considerable distance by land management (32.5%), infrastructure (27.7%), building & construction (26.9%) and urban planning (24.1%). It is fair to say, however, that there is a degree of overlap between land surveying and the other areas.

Classifying geomatics professionals

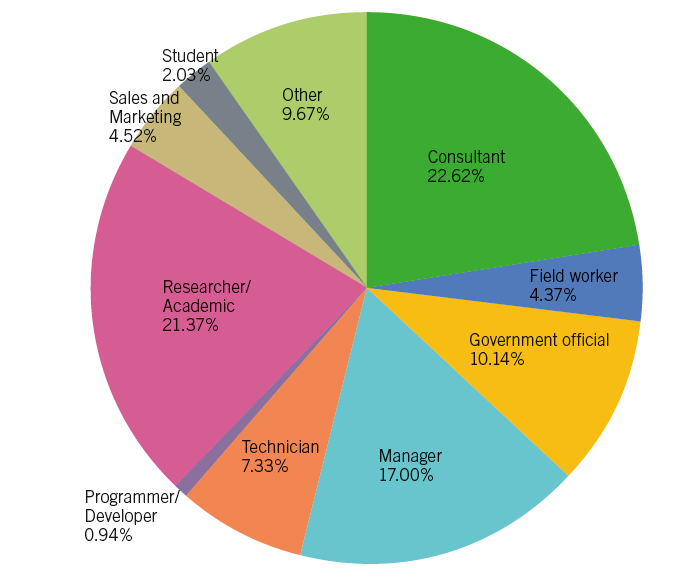

Let’s dive a bit deeper to find out more about the geospatial professionals who participated in our survey. Who are they exactly? We asked them what best described their job title. 22.7% chose consultant as their answer, closely followed by researcher/academic (21.4%), with manager (17.6%) completing the top three (Figure 1). Geomatics consultants can be defined as mapping and surveying experts providing the full spectrum of surveying, monitoring, 3D modelling and imaging services to a wide-ranging client base. Many surveyors are working for consulting firms. AAM Group, COWI, Fugro and Woolpert are just a few well-known examples of consultancy companies that provide accurate and comprehensive surveying, mapping, geomatics engineering and 3D analysis services for civil engineering infrastructure and other projects.

The geospatial professionals working as researchers or academics are often employed at universities in the civil engineering (or similar) department or faculty, where they are involved in geomatics-related research and education. It is also worth mentioning the notably high representation among our survey respondents of geospatial professionals working as government officials.

Optimistic outlook for geospatial industry

In addition to gaining insight into the industry demographics, GIM International’s annual survey is also a good opportunity to measure the general business mood. We asked geospatial professionals about their expectations regarding the prospects in the surveying market in 2019 in comparison with the last three years. The outcome was very similar to last year’s poll: about 19% expect a much better business environment, while roughly 48% foresee some improvements. 26% expect the market situation to remain stable.

So the overall vibe is positive and optimistic, with the most promising perspectives stemming from the lively construction and infrastructure sector. This is especially the case in the likes of China, India and the Middle East, where numerous vast and prestigious projects for new cities, highways and railways are in full swing – with even more in the planning and development phase. Hence, the prospects look particularly good for companies involved in construction and engineering. However, it should be pointed out that there are some potential constraints. These are not unique to the geospatial industry; the widespread optimism in the surveying market is most at risk from geopolitical developments. International relations, the worldwide political order and potentially disruptive events can all have an impact on the global economic situation. How will Brexit play out, and how will it affect the economies of the European Union as well as the UK itself? Other regions to watch are the Middle East (will stability increase?), the USA (how will the economy develop?) and China (what will happen to the economic growth curve?). And on a global scale: will import tariffs and other protectionist measures become the new trend, or will the governments of the main economic powers scale back their intervention in the worldwide economy? All of these factors will have a direct influence on the geospatial industry.

Defining growth opportunities in geomatics

We asked our readers where they see growth opportunities for surveying in their current sector. This was an open-ended question, and close analysis of the answers reveals several interesting points. The most frequently mentioned sectors that offer growth potential for surveyors include land management, construction, infrastructure, urban planning and smart city projects. The application of unmanned aerial vehicles (UAVs or ‘drones’) for mapping and surveying projects in all kinds of areas is another clear growth opportunity, according to the survey.

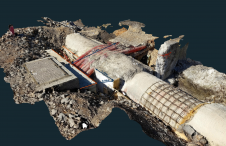

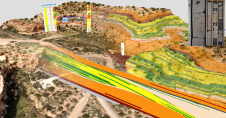

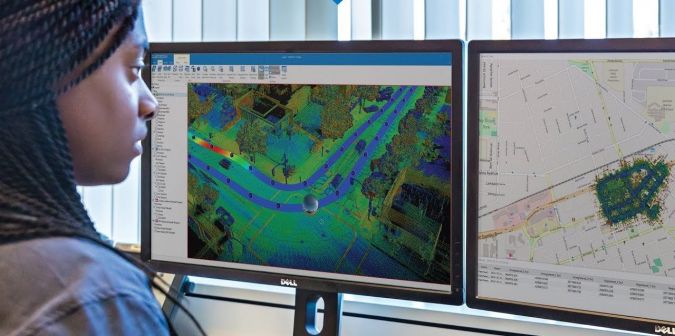

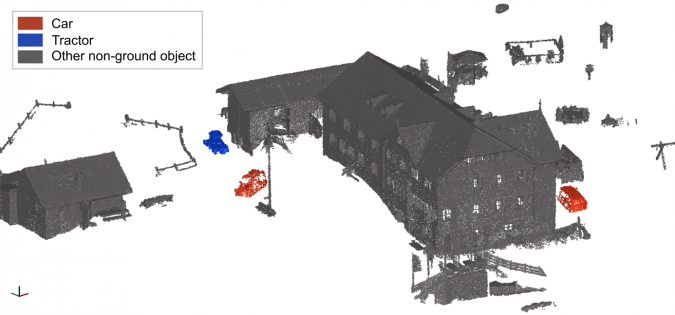

One of the key pillars underpinning the widespread positivity among geomatics experts is the rapidly expanding need for 3D geodata, driven by the huge – and ever-growing – interest in the construction of 3D models of urban and built environments. This is obviously directly related to the countless large infrastructure and construction projects that are under way all around the globe. As one of the survey participants very aptly describes: “Entire cities all over the world will get their digital twin, and location will be the key for combining all sorts of data”. Indeed, geospatial data is the backbone of the digital replica of cities. This burgeoning demand for 3D geodata offers a wealth of new opportunities, in response to which many companies in the geospatial industry are heavily involved in innovating new digital mapping and rendering techniques (Figure 3). As illustrated by the vertical division of the customer base to focus on distinct fields of application, more and more companies are developing ever-more advanced geospatial tools to represent the 3D world in line with specific application-related needs.

The need for new mapping solutions

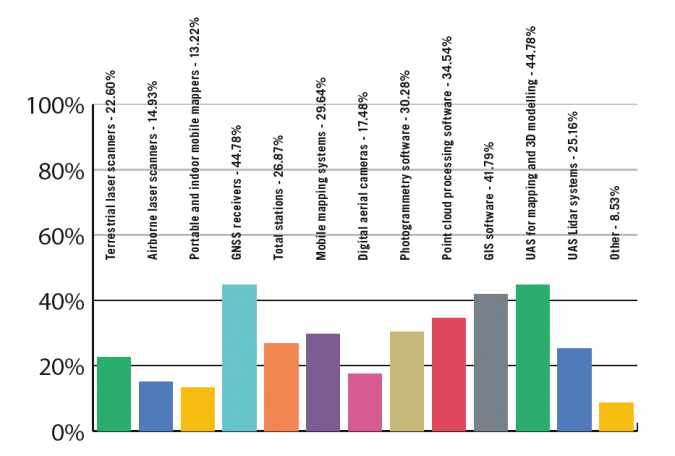

Last year, an astonishing 70% of the survey participants revealed that their organization was planning to invest in new systems. This figure has fallen slightly this year, but still shows a very positive outlook for manufacturers and developers of mapping and surveying solutions, with almost two-thirds of organizations intending to purchase new equipment and software – but which types of systems? UAVs are the clear winner: 45% of the geospatial organizations plan to invest in an unmanned aerial system (UAS) for mapping and 3D modelling, while a further 25% have plans to acquire a UAS-Lidar system. So the future looks bright for drone companies involved in the mapping and surveying field.

The drone has overwhelmingly succeeded in its mission to acquire a permanent place in the surveyor’s toolkit. The 2019 GIM International survey clearly indicates that the UAS has become an important instrument in the geospatial industry, just like total stations, GNSS receivers and – in various guises – laser scanners. In light of this, maybe the time has come to wonder why there are so many trade shows focused on UAVs. Perhaps it’s putting it a little bluntly, but imagine if professional surveyors were expected to attend events that only showcased the latest total stations, or that geobusiness delegates would visit an exhibition solely dedicated to terrestrial laser scanners…

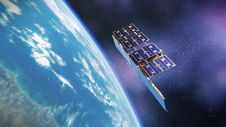

GNSS receivers remain crucial for surveyors as core devices for satellite positioning. Almost 45% of our respondents state that their organization is planning to spend money on such devices. As the workload for surveying professionals is likely to increase, the demand for GNSS receivers is obvious. There are so many different applications for GNSS receivers that we cannot list them all here, but the fields in which surveyors are involved in the geomatics industry (as outlined above) give a good general indication of their usage.

On the software side, about 35% plan to invest in point cloud processing software, closely followed by photogrammetry software – 30% of the organizations intend to obtain new photogrammetry software (Figure 4). In a previous GIM International survey, we asked geoprofessionals what they valued most about their chosen geodata acquisition method. Interestingly for providers of photogrammetric solutions, high accuracy topped the list of priorities (scoring more than 65%). This was closely followed by spatial resolution/point density (just over 50%). Processing software reliability came third with 33%, followed by aspects such as rapid availability of final products and a well-established workflow. These findings are echoed by the respondents in our latest survey.

The impact of new technology on surveying

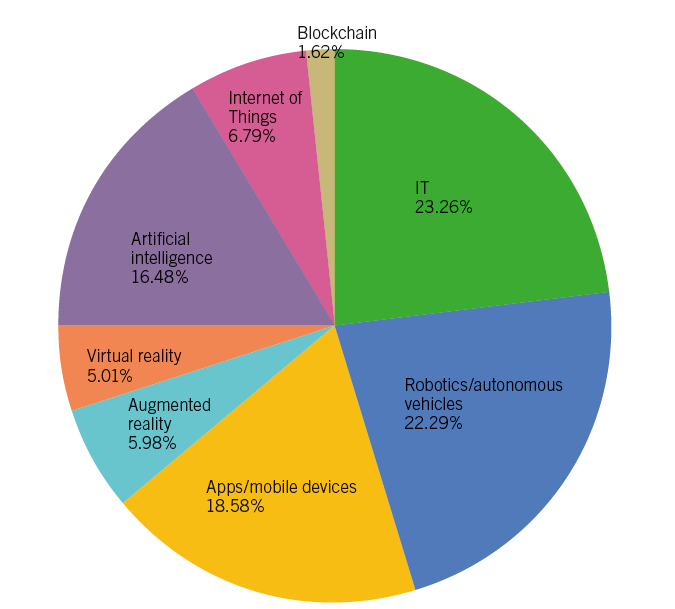

At GIM International we strive to report on the state-of-the-art mapping and surveying solutions utilized by experts all over the world, so our annual survey is also an excellent opportunity to ask our highly valued audience which technology they believe is currently having the greatest impact on the surveying profession. In this case, instead of a ‘top three’ we have ended up with a ‘top four’: IT, robotics/autonomous vehicles, apps/mobile devices, and artificial intelligence (AI) are all regarded as technologies that will have a major impact on the geospatial business (Figure 5).

At the same time, it is also interesting to learn which trends our respondents foresee over the next five years. This will hopefully inspire suppliers of innovative mapping and surveying solutions to continue pursuing their R&D efforts that are set to change the professional surveying environment. In response, various ‘hot topics’ are mentioned, such as the integration of GIS and BIM, the increasing role of AI into geomatics (Figure 6), and the integration of systems and interoperability, but we also received some more future-oriented comments, many of which referred to the digital transformation. There is no doubt that digitalization is having an extremely disruptive impact, but is this also an advancement in every sense? One of the survey respondents sums up the sense of loss of ‘times gone by’ as follows: “I guess all these IT solutions will be the most important trend in the future, with less and less emphasis placed on traditional survey methods. Unfortunately, with this development, intuitive methods are slowly taken away…”. At GIM International we trust that the established companies as well as the ‘new kids on the block’ will help to prevent us from becoming too nostalgic. Ultimately, the adoption of high-end geospatial technology in many applications in wider society will open up a lot of new opportunities for tomorrow’s surveyors. This may make their work a little different from that of traditional surveyors, but probably no less exciting.

Value staying current with geomatics?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories to help you learn, grow, and reach your full potential in your field. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired.

Choose your newsletter(s)