GeoEye-1 Scheduled Launch in 2007

GIM Interviews Matthew O’Connell, President and CEO, GeoEye

On January 12th 2006 came the announcement that Orbimage had acquired Space Imaging. The newly formed company, GeoEye, flies the high-resolution Ikonos, Orbview-3 satellites and Orbview-2. In 2007 it will launch the very high-resolution GeoEye-1. Our interviewee Matthew O’Connell has 25 years experience in Mergers and Acquisitions. Some years ago he left Wall Street to work full-time for Orbimage, exploring the exploitation opportunities of acquiring Space Imaging.

After the acquisition the brand name changed into GeoEye: why?

We are in the business of providing GeoInformation and Geo-Intelligence. In a way, GeoEye is short for that. And our three satellites can ‘see’ the entire world, so the name fits visually exactly what we do. Without GeoEye you could not have GeoInsight! A new name would also help to speed the consolidation of the two companies, so all the employees felt like they were part of the same team.

GeoEye: Background

GeoEye is the name of the newly formed company created when Orbimage acquired Colorado-based Space Imaging. The company is headquartered in Dulles, Virginia, just outside Washington D.C. It has three hundred employees, and facilities in Thornton, Colorado and St. Louis, Missouri. GeoEye is publicly traded and the world’s largest commercial remote-sensing company: combined revenues in 2005 were US$160 million. The company flies three commercial imaging systems: the high-resolution Ikonos, Orbview-3 satellites and Orbview-2. The latter is an ocean-monitoring imaging system used by the fishing industry. GeoEye has more than a dozen Regional Affiliates and Regional Distributors around the globe. These are customers who have purchased ground-stations and actually buy imaging time on the satellites. European Space Imaging is one such commercial station in Europe. Another is SCOR, the Satellite Center for Regional Operations in Poland. Other ground-stations are located in the Middle East and Asia.

What are your main types of prducts, who are your main clients and how is your customer-base distributed over the continents?

GeoEye has the world’s largest archive of high-resolution commercial satellite imagery. More than 253million km² have been collected since the Ikonos satellite was launched in late 1999 and Orbview-3 in the summer of 2003. Our imagery can be processed to various levels of accuracy, depending on the customer’s requirements. We have a state-of-the-art value-added processing facility in St. Louis, Missouri where we can take imagery and combine it with other geospatial products to make more advanced products. Our single biggest customer is the Pentagon’s National Geospatial-Intelligence Agency (NGA). But the international market is very important to us, since about half our revenues are derived from our international ground-stations and from our international resellers. Customers can get access to Ikonos imagery directly from our ground-stations in South Korea, Japan, Singapore, UAE, Thailand, Germany and Poland. We also have ground-stations associated with governments only and the imagery provided to those stations is not for commercial sale.

What technological developments do you expect over the coming decade in image-data capture and information extraction from imagery?

Let me, to answer this question, go back for a moment in history. In 1900 a national American magazine, Ladies Home Journal, made the prediction that by the end of the century “Flying Machines will carry powerful telescopes that beam back to earth photographs as distinct and large as if taken from across the street”. That prediction came to pass almost a hundred years after the magazine had made it, with the launch in 1999 of the Ikonos sat-ellite. Now we are at the point of integrating this technology into the way we do our business. The integration will not be revolutionary, but rather evolutionary. From my vantage-point, I see imagery providing a competitive advantage to those who use it. Our population is increasing but our resources aren’t, so we need to know more about our world. Geospatial imagery and information are crucial to our future…

… What does that mean for your own plans concerning technological developments?

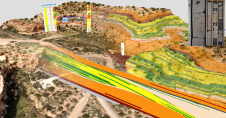

…With the above view on the future, we are developing a next-generation imaging system, GeoEye-1, which is fully funded and slated for launch in the first quarter of 2007. With a resolution of 0.41 metre in the panchromatic (black and white) mode and 1.64-metre resolution in multi-spectral (colour) mode, it will be able to collect about 700,000km² daily, equivalent to the size of Texas, Poland or Turkey. It will be very agile and have four ground-stations in Virginia, Alaska, Antarctica and Sweden. The sub-metre resolution enables counting manhole covers on a city street and precise location of objects on the surface of the Earth at an accuracy never before available from a commercial satellite. We are investing $250 million in our next-generation system, and that is matched by an equal investment from the US government. Further, we plan to work with our national and international resellers and help them exploit the value from our imagery. We operate a state-of-the-art, value-added processing centre in St. Louis, Missouri. The scientists there are working on even more advanced processing systems and looking to the future and developing proprietary technologies. While I cannot talk about specifics, I can say they are pushing the edge from a technology point of view. As technology moves from the desktop to handheld devices we will explore the possibility of developing mechanisms to deliver imagery products directly into the hands of an individual in the field using PDAs.

From a business perspective the last decade may be characterised as the era of take-overs. What were the grounds for Orbimage to acquire Space Imaging?

The possibility of acquiring Space Imaging was one of the elements that caused me to leave Wall Street and join Orbimage full-time a few years ago. There were three companies in one sector and none of them were generating a good return on equity, so there was a clear opportunity for consolidation. We had an opportunity to buy Space Imaging after it lost the important Nextview contract from the Department of Defense. Once that happened, we knew they were in play and ripe for an acquisition. But once an acquisition is made you must have a good team to integrate the two cultures. We have a very good senior team. Our COO Bill Shuster and CFO Henry Dubois have many years of industry experience and we hired many of the top-notch people from Space Imaging. Everyone thinks the hardest thing about Mergers and Acquisitions is finding the money. It is actually the easiest. I have been doing this for 25 years, as an advisor, then an investing principal, and finally as a CEO. The first real hurdle is to find a good deal. Once you find a good deal, money will find you. But then the really hard part comes: integration of two different cultures and executing the business plan. That process is currently underway at GeoEye and it is going quite well.

Is the take-over also fuelled by the opportunities thus created to combine image-products from the various earth-observation systems and so serve your customers with more competitive value-added image products?

Having multiple high-resolution satellites available for customers’ orders provides numerous benefits, including more frequent visits over an area, larger-volume collections in a shorter period of time, improved overall reliability of operations and a wide range of imagery products from current imaging systems. GeoEye will offer even more sophisticated products with the launch of the GeoEye-1 satellite in about a year. So our customers have the benefit of many years of continuity of service. Ikonos will operate through 2008 or longer; OrbView-3 will operate through 2010 or longer, and when we launch GeoEye-1 it will operate until 2015 or longer. It is great to be able to tell the market “We can give you assured access to the highest quality colour commercial satellite imagery for the next decade.” Governments and commercial customers and our Regional Affiliates can count on having a steady stream of imagery for over ten years.

Does the acquisition of Space Imaging mark the onset of a series?

As far as the remote-sensing industry is concerned I think we are, at macro level, on a stable track now that GeoEye is up and running. There are now two, no longer three, high-resolution earth imaging companies in the US, which is more in line with the desires of the US Government. I do not foresee any major changes in our industry other than growth. While we do intend to grow the company through strategic acquisitions, that is not a high on our to-do list right now. We are focused on integrating the company, launching GeoEye-1 and providing great service to our customers.

In terms of competition, how do you see the emerging earth-observation micro-satellites, such as the recently launched UK TopSat, which provide high-resolution images of a specific location in real time?

The number of imaging systems that are being launched by governments and quasi-governmental organisations is staggering. We are truly entering an ‘age of transparency’ where we are being flooded by pixels from above. Regardless, the business of looking down is, excuse the pun, looking up, in spite of all the competing systems. Such competition will only create a demand for new products and services. The search engines such as Google and Microsoft’s Virtual Earth are just beginning to utilise remote-sensing technologies. Yet their use of im-agery was never factored into any of the original business plans of the companies now flying im-aging systems. Just as important as the picture is the accuracy and quality of the imagery. The customer wants high-resolution and high-quality colour pixels. Both go hand in hand for a quality solution. We’re watching the micro-sats closely. They are certainly an intriguing development, especially for a company that is as cost-conscious as we are. But their applications are somewhat limited, so we haven’t yet decided whether we will experiment with them.

How do you see your role as a geo-data collector within the context of ‘the homeland security’ debate?

Geospatial provides a common operating picture and situational awareness of domain: important tools for the homeland-security customer. Homeland security is often focused on buying more guards, gates and guns that some-times drain resources without providing more security. Action without planning can be inefficient. Funds should be used to purchase archive satellite imagery that could become the base-map upon which other information can be overlaid. It is particularly effective when we capture an additional image with information that can be applied to the situation. Imagery taken of New Orleans after Hurricane Katrina has more meaning when joined with the ‘before’ imagery. Overhead geospatial change-detection does matter and provides a certain context and content one can’t get just from observing on the ground. According to the WorldWatch Institute, in the 1990s natural disasters affected about two billion people and caused more than $600 billion in damage. Commercial imagery can help plan and prepare for the next disaster and help mitigate damage from it.

How do you see the future of earth observation by images in relation to the rapid developments going on in the GIS domain?

Just as we saw a merger of law, market forces and technology in the early 1990s that enabled remote-sensing technologies to emerge from the shadows of the intelligence community, we now are witnessing the merger of imagery, GIS, GPS and the internet that may spark a revolution in the way we use this technology. While each of these technologies is powerful in its own right, it is when they come together that they may create real change. We see these technologies no longer in stovepipes but becoming horizontally integrated to solve tough business and national-security problems. GeoEye has a new relationship with Microsoft, and both companies are exploring the opportunities of marrying software and imagery content. We will focus less on the business-to-consumer market with our Microsoft partner and more on the business-to-business opportunities. GeoEye will be a major force in testing the online mapping business model and associated opportunities.

Value staying current with geomatics?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories to help you learn, grow, and reach your full potential in your field. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired.

Choose your newsletter(s)