Improving Local Government Services in Jamaica

Tapping into the Value of the Real Estate Market

In developing countries worldwide, governments and citizens hold massive amounts of real property and unmovable assets that are hidden or underutilised. Citizens, and in particular the poor, are unable to maximise economic output from real property. The situation in Jamaica was no exception to this problem in 2015. Against this background, the challenge was to design and implement a self-sustaining property information and valuation system which could generate both information and greater tax returns for the government land office.

(By Keith Mantel, Walter T. de Vries and Michael Kirk)

This was an interesting and challenging experience. Not only did it lead to the discovery of a demand across all sectors of society for freely accessible information regarding land and property data, but it also provided an alternative for the private sector to create a transparent, user-friendly, mobile-accessible website that displays all of this data for free. This can be accomplished by using the advertising potential that lies within the value of real estate for sale and rent. This article provides a personal narrative of an incremental research and development experience.

As often occurs, research and development questions emerge while conducting on-site investigations. It was identified from previous work in March 2015 that Jamaica’s National Land Agency (NLA) was still relying on old-fashioned computing technology that was in dire need of an overhaul to improve employee efficiency and productivity.

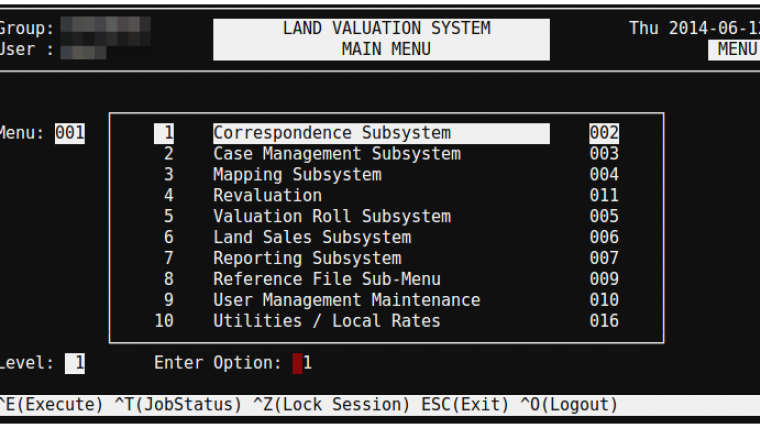

The first issue is immediately clear; the back-end database for the valuation division is woefully out of date. Figure 1 shows a screenshot of the system, called LVS. Designed in the 1980s, it still resembles a DOS interface with DOS-like usability, lacking a spatial component or mouse functions. This is the interface that the Agency uses to maintain the Valuation Roll for all of Jamaica. It is not only outdated and inconsistent, but also not freely available for public use and scrutiny.

The second major issue is the NLA website, called iMap, that is used to display land information (Figure 2). Some major deficiencies include:

- Poor user interface from an outdated Esri template

- Not enough bandwidth, making it slow or completely inaccessible and forcing NLA employees to use other services that do not offer the same depth of information

- No data integration with other eGovernment services

- Not designed for public consumption and inaccessible from mobile devices

- Outdated imagery – in many parts, coverage is from 2001.

In order to redesign the system, the focus was initially on testing a prototype in a single district and assessing its property data with alternative technologies. Disparate datasets were collected from within NLA to include parcel boundaries, valuations, historical sales and property tax. Microsoft Excel helped to clean the data and Quantum GIS (QGIS) helped to create a new integrated shapefile. With the new shapefile, random sampling of field sites served to determine the accuracy of these datasets. The test site was the district of St. Ann’s Bay on the north coast of the country. This was a representative site in terms of median parcels and property tax compliance. The variables to test included:

- The accuracy of the parcel polygons (both size and placement)

- The sales data, to include discrepancies in price and availability

- The valuation roll.

Prototype

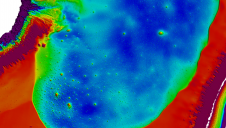

Figure 3 shows a screenshot of the integrated shapefile created in QGIS. The parcels in this image are colour coded by property value (price per m2), but the graduated symbology can be changed to reflect various criteria. Underneath the parcel layer is 50cm satellite imagery taken just months prior through a Digital Globe Foundation grant.

Obtaining the market value of an asset is crucial to a well-functioning free economy. For real estate, the most frequently used method is the ‘sales comparison’ approach. By incorporating sales data into the shapefile, it was possible to test multiple variables at once by selecting only those properties with sales data for the sample. Through visits to the property in person, it was possible to test not only the accuracy of the NLA’s GIS layer and valuation, but also the accuracy of sales data.

A wide range of stakeholders had the opportunity to react and comment on the prototype, including squatters, large-scale land investors, home owners and employees of various government agencies. Respondents from every income level and employment status validated this prototype’s utility and ease of use, indicating that consumer demand for accessible property data was not being met.

The way forward

As could be expected, the comments and responses to the first prototype were not unanimously positive. Crucial, however, was that the planned computer-assisted mass appraisal (CAMA) system could not be immediately constructed. Building a CAMA system requires an abundance of recent sales data. Due to low property turnover, under-reporting and missed reporting, there is less than 5% coverage of reasonably accurate sales data in St. Ann’s Bay, which is insufficient for building a CAMA system.

Another complication before scaling up such a system is its potential utilisation in the taxation realm. To understand this, an example of the impact of gross undervaluing can been seen with the parcel ID# ending -041. For property tax purposes, the Ministry of Finance uses the last accepted land revaluation, which is from 2002. According to NLA, this lot is valued at JMD20 million. However, the vacant lot sold last year for JMD370 million. Since the market value for this parcel is nearly 20 times the Valuation Roll, the effective tax rate is less than 0.1%.

Making the undervaluation more severe is that parts of this shoreline are developed. One property owner, a foreign developer who moved to Jamaica to build luxury condos, owns the entire peninsula (approximately 23 hectares of prime seafront land). He also owns the adjacent lot to the east, the tiny parcel whose number ends -044, which featured a completed 32-unit condo.

The market value of the condo is around JMD1.5 billion, yet the parcel is valued by NLA at just JMD1.5 million. The improvement is more valuable by a factor of 1,000 times the land and results in a property tax payment of JMD22,000 instead of JMD8 million. Needless to say, it is difficult to have well-functioning government services when the property tax rate is 0.006%. But the owner of the land is not doing anything illegal. He is utilising a loophole created by the failure of the government to adopt current market valuations for land and tax them appropriately.

The Government of Jamaica struggles to collect property tax on par with OECD countries due to three main reasons. First, compliance rates in Jamaica average only around 50%. Second, only the land is taxed, rather than improvements. Third, the valuation is not pegged to the current market value, but relies instead on values from 2002.

The chart in Figure 4 compares property tax collection of the sample area under Jamaican standards and US standards. On average, Jamaica collects about 9% of what the US would collect in the same area.

Creating a new entity: Itabo

With open government data in mind, the idea arose to create a company called Itabo. Its goal is to dissolve the information silos and create a transparent real estate market built on a comprehensive database. Leveraging the US Open Data Initiative and a location-based, targeted advertising revenue model, Zillow (the leader in this field) has maintained free access for all users. While ample opportunities for similarly targeted advertising exist in Jamaica, US companies are not interested in taking on the challenge of moving abroad. But where they see obstacles, there is an opportunity, a step toward achieving transparency in property transactions worldwide. As such, Itabo’s focus is on the development of a mobile-responsive platform. Pending traction in Jamaica, the plan is to expand into greater Latin America.

Conclusion

As stated earlier, whilst the focus was not only on analysing the problems of land data in Jamaica, the work also served to identify – or in this case, create – potential solutions. There are myriad Jamaican websites that display properties for sale. Anyone can create a classified advertisement with a sale price and photos. However, to make an informed decision about selling or purchasing property, considerably more data is needed. In Jamaica, this information-intensive process poses an immense challenge. Once you find a property for sale on one of the aforementioned websites, you need to visit another website to find its parcel boundary. You then make your way to a third website for land value, a fourth for sales data, and a fifth for property tax records. Each of these websites presents its own obstacles for the user, be it a high subscription fee, lack of mobile accessibility or a complex interface that requires prior knowledge of GIS. Hence, important land information is locked into separate silos (see Figure 5). Processes that should be simple are inefficient, affecting both citizens and the government while deterring foreign investment.

Land and property information is dominated by government agencies. Governments are meant to be the authoritative source for information, not data merchants. Property data in Jamaica is privileged information. However, there is an opportunity to start using open government data. This is a movement that has struggled to gain traction in the developing world, but could greatly assist in balancing information asymmetry.

Acknowledgements

A special thanks to the members of NLA for allowing the research to be conducted and for being so forward-thinking in adopting solutions.

About the Authors

Keith Mantel is founding director of Itabo.

Walter T. de Vries is a professor and holder of the Chair in Land Management at the Technical University of Munich, Germany.

Michael Kirk is professor of development and cooperative economics at the Marburg Centre of Institutional Economics, Philipps-University Marburg, Germany.

Value staying current with geomatics?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories to help you learn, grow, and reach your full potential in your field. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired.

Choose your newsletter(s)