High-end UAVs: A Key Link in the Value Chain

Interview with Michael de Lagarde, CEO, Delair-Tech

Unmanned aerial vehicles (UAVs or ‘drones’) have become an essential tool for land surveyors. The geospatial industry is turning to drones to map the environment, which is also impacting the commercial UAV business. Delair-Tech is a prominent company in the industry and attracted particular attention when it acquired Gatewing from Trimble in 2016. In this interview, 'GIM International' asks Michael de Lagarde, CEO of the France-based company, about the company’s strategy, outlook on the UAV market, cameras, fields of application and much more.

You recently announced that 2016 was a record year for Delair-Tech. Does that mean that the professional UAV industry is booming?

Over the past six years the commercial UAV technology has evolved quickly, preceded by the developments in recreational drones on the consumer market. Commercial machines have now reached the appropriate standards in ergonomics, safety and data quality. The legislation has followed the technological progress. Europe, and especially France, has been a pioneer, joined in 2016 by the USA with the release of Part 107: a set of rules that lays the foundations for the commercial use of drones. Every country in the world is following this path. 2017 will be the year of market adoption. Many industries have tested the tailored solutions that were designed specifically for their fields of activity, and have discovered that they add significant value. They are now convinced and ready to deploy on a large scale.

You have defined three strategic priorities for 2017. Can you tell us more about them?

Certainly. The first of the strategic priorities is structuring the commercial offer around verticals to continuously improve the value proposition to the final customer. In each of these sectors – power & utilities, geospatial, mines & quarries, oil & gas, railways & roads, emergency, security & defence, and agriculture & forestry – Delair-Tech proposes a specific solution, so that the drone-based tool chains are integrated seamlessly into the current processes of industrial users, with the highest possible added value.

The second priority is to continue the R&D effort. The objective is to capitalise on Delair-Tech’s field experience and create second-generation drones and associated data-processing software – more efficient and best adapted to the specific needs of large industrial groups.

The third priority is international business development. Our company will continue to expand and strengthen its global network for the distribution of hardware and software. We will also focus on developing our service offerings worldwide, responding to the demand of industrial customers who wish to benefit from this technology without bringing drone operations in-house. Delair-Tech offers its customers experienced specialists to provide them with turnkey deployment solutions, while ensuring the safety of the operations and the quality of the results.

There are many developers of professional UAVs. What makes Delair-Tech’s UAVs different from other manufacturers’ UAVs?

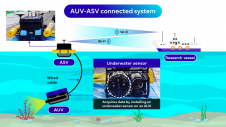

Delair-Tech provides end-to-end drone solutions including hardware, software and services. Through a single interface, our industrial customers get the best fit-for-purpose drone solution to help them make informed decisions and boost their productivity thanks to aerial data turned into actionable business intelligence. On the hardware side, Delair-Tech’s drones are long range. They are the only ones in the world certified for operations beyond the visual line of sight (BVLOS) and equipped with professional-grade payloads, from photogrammetric cameras to Lidar. The range of available products is one of the widest on the market and meets the majority of industrial customers’ needs. On the software side, our cloud platform is simple and efficient. We have experience with paying customers since 2012. This is mainly due to French aerial regulations which have authorised professional UAV activities since 2012, whereas the legislation has been very restrictive in other countries. Therefore, Delair-Tech masters the entire drone technology value chain, from hardware to application-specific data processing. The results are highly integrated products delivering high added-value data. This advantage has been a key differentiator in the extremely competitive drone market and has enabled Delair-Tech to become a ‘one-stop shop’ for drones for commercial use.

With new companies emerging all the time, the UAV market still appears to be soaring. Do you agree?

Six years ago, the UAV landscape was mostly populated with small groups of hobbyists or academics, each developing their own prototypes. Requiring only a limited initial investment, small UAVs were generating much enthusiasm and hence rapidly gained in popularity. However, while it is certainly an achievement to get a demo version to fly once, developing machines that can be produced on a large scale and flown for hundreds of hours requires tremendous effort, time and investment. In the face of this tough reality, the UAV manufacturing population has drastically shrunk since then. Today, platform manufacturers have become scarce, on both the recreational and the professional markets.

The recreational UAV market is now saturated, with few prospects. The race is over and clear leaders have emerged. The market is dominated by mass producers that are engaged in a price war, while the bubble is progressively deflating…so the focus is now shifting from leisure drones to commercial drones. B2B customers require credible partners, capable of delivering effective solutions in a reasonable time – hence the trend towards industrialisation and consolidation, while the smallest business or academic actors are progressively disappearing. There is currently a lot of hype about the data processing software part which appears to be carrying a large part of the added value along the chain, but the end customers are focused on finding efficient end-to-end solutions and the software is only one part of that.

UAVs are often equipped with cameras that don’t match the quality of stable metric cameras. Which developments can we expect in this area?

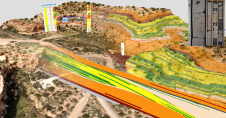

Consumer cameras are inexpensive and yield data with a quality that is fit for an entry-level UAV. Of course, a number of basic tasks can be achieved using consumer-grade UAVs. However, in all data processing workflows, the quality of the input is crucial to the quality of the results – hence the importance of the hardware that captures the raw data. At the end of the day, people want the best possible result for their business analysis. The best way to achieve that is to consider the data processing chain as a whole, and to optimise each link. The first link is the hardware, and optimising this often results in using a high-end UAV rather than an entry-level one. High-end UAV cameras need to be adapted to a demanding set of constraints: high dynamics, vibration, changing lighting conditions, and to produce photogrammetry-grade data with high resolution and reduced blur and distortion. Sensitivity of the sensor, aperture time, resolution, optics…everything is optimised to produce the level of quality required for a specific application. Sensors are integrated into the on-board system and can be controlled from the ground by expert operators, and the data quality can be checked in real time throughout the entire acquisition process. The capacity of a UAV company to design its own photogrammetry sensors results in a product with a high level of integration, facilitating workflows for optimised data quality.

Capturing imagery is one thing, but after that it’s all about processing and visualisation. How do those aspects work when using Delair-Tech UAVs?

All professional drone solutions are composed of two inseparable steps. The first is data acquisition: UAV operators deploy a mission-suitable UAV within the zone of interest by. At this stage, special attention needs to be paid to safety, compliance with aviation rules and data quality. The output is a huge volume of unsorted raw data, i.e. big data, which is worthless unless it is processed in order to extract the valuable information. The second step is data processing using a software suite – a cloud-based platform with a simple and easy-to-use interface. The data is uploaded and goes through a number of processing steps, including quality control, photogrammetry and business analysis. The output is data analytics – in this case a report containing the business-specific intelligence needed for the end user to act upon. Using an integrated drone solution, including both the hardware and software, simplifies the overall workflow and provides the best user experience.

You also offer a Lidar-equipped UAV. What are your expectations of UAVs carrying a Lidar sensor?

The expectation of many UAV-based activities is to reduce the operating costs of aerial data acquisition compared to the traditional methods, like planes or helicopters. With our Lidar product, we intend to combine the efficiency and the data quality of a VUX1 RIEGL Lidar with the ease of deployment of a UAV. DT26X-LiDAR is particularly adapted for power line inspections or land surveying in large areas with dense vegetation. Typical accuracy (1 sigma) is less than 4cm along the XY axis and less than 2cm along the Z axis, which opens up a large field of applications.

You acquired Trimble’s UAV business and signed a strategic alliance with Trimble at the same time. Can you tell us more about that relationship?

In November 2016, Delair-Tech purchased Gatewing, Trimble’s unmanned aircraft systems (UAS) business. Established in 2008, Gatewing has been active in the commercial UAV market for a long time and the company has pioneered UAV-based photogrammetry solutions. Through this acquisition, Delair-Tech intends to reach the critical size required to best serve the needs of large industrial groups in a market that is currently undergoing intense consolidation. Both companies have merged their teams and are creating synergy between their technologies, facilities and know-how, thus significantly increasing capacity for innovation and production. With a total workforce of 110 employees, the newly created group is one of the main players in the global professional drone market.

Alongside that acquisition, Delair-Tech and Microdrones have signed strategic commercial agreements with Trimble. Delair-Tech has teamed up with Microdrones, a long-established supplier of multirotor systems, to offer a comprehensive range of products. They jointly became official suppliers for Trimble’s worldwide distribution network (150 dealers in 80 countries), which sells UAS and image-processing systems to the construction, agriculture, transport, geomatics and energy sectors.

You’re also targeting the precision agriculture market. What are your thoughts on agriculture and UAVs?

We are targeting the digital agriculture market, which put briefly means getting precise and real-time crop insights so that the inputs can be aligned with the need of the plants in the field. Precision agriculture is still in its infancy, but the digital agriculture revolution is underway and UAVs are part of it. There was a lot of buzz around UAVs and agriculture, but sound and useful solutions are now emerging from the hype – ones that are really industrialised, that bring clear value and that fit in with daily agricultural or horticultural operations. For example, UAV solutions give seed breeders a tool that screens and describes the crop characteristics of entire research fields in a single flight – faster, with more precision and at a lower cost than conventional methods.

Which other fields of application does Delair-Tech consider to be very promising?

In addition to geospatial and agriculture, which are currently the most mature markets, we’re also focusing on several other verticals that we consider very promising in the short term: power & utilities, oil & gas and surveillance. For the first two, the main applications consist of bringing innovative tools and solutions to enhance the recurring maintenance of infrastructure, i.e. the customers’ major and strategic assets. In these markets, the drone is used as a substitute for traditional inspection and data collection methods such as on foot or by helicopter. The long endurance and BVLOS capabilities of the UAV, plus activity-specific software modules, are Delair-Tech’s strong suit here. We offer mature products that have been tested, compared and proven to be more efficient than conventional methods over large distances (often several thousands of kilometres).

In the surveillance market, areas are patrolled to spot intrusions or malicious acts, so this differs from the other value propositions – survey, monitor & inspect – associated with maintenance tasks. Real-time surveillance requires a real-time video feed. At Delair-Tech, we have chosen to address a broad range of sectors instead of specialising in only one. Designing professional-level UAVs and data processing software requires massive investments. Addressing several markets at the same time, with technologies that have many commonalities, is a way to spread these investment costs over wider sources of revenue.

Which changes do you foresee in the coming years regarding the role of UAVs in the geospatial industry?

As the regulations and the technology evolve, the UAV will become a standard tool for the professional surveyor. Until now the market has been drawn to entry-level products, which is understandable at adoption time. But users are increasingly realising the limitations of these products and are migrating towards ROI-driven usage. For professional use, it is not just the UAV but the whole solution that matters. It is now acknowledged that UAVs are only a part of the entire value chain; higher-end products will be chosen if they increase the efficiency of the overall solution.

The need for ‘drones as a service’ is also developing in many industries. Infrastructure managers realise the potential of drone-based solutions in their daily work, but don’t want to bring the activity in-house as it is not their core business. All this is a gradual and inevitable rationalisation and a normalisation of the use of these new tools that are progressively changing the way we work and helping us to move into the digital age.

About Michael de Lagarde

Frenchman Michael de Lagarde obtained an MSc in physics from École Polytechnique, Paris, in 2004. He started his career in the oil industry with Schlumberger as a wireline field engineer. As head of an intervention team, he managed the deployment of high-tech measurement tools during onshore and offshore drilling operations. Having first been based in Red Deer, Canada, he later moved to Yopal, Colombia. He subsequently became a petroleum engineer at Perenco, as offshore operations manager, in Egypt for the start-up of a gas production plant. When that project finished, he moved back to Paris and became part of the petroleum engineering flying team in charge of production optimisation at group level, with various spot assignations (mostly in East Africa). In 2010, he laid the foundations for Delair-Tech and developed the first UAV prototype. A year later he was joined by his three co-founders and they formally founded the company in Toulouse in March 2011.

Value staying current with geomatics?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories to help you learn, grow, and reach your full potential in your field. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired.

Choose your newsletter(s)