Blowing in the Wind

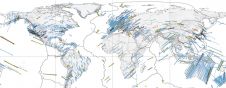

Our globalised economies are awash with money for investment. Over the past decade global capital flow has almost trebled to reach over 16% of world GDP. This has an impact upon the lives of everyone on earth: for instance, the financial crisis of 1997-98 caused catastrophic problems in many East Asian economies. But there are also massive ‘up-sides’ to globalisation. It is a crucial element in improving the standards of living by economic integration of nearly half the global population living in India, China and surrounding countries.

Capital Accumulation

Yet, as pointed out to me by a Swiss banker, our knowledge is limited regarding where money moves from and to. At best we have highly aggregate ‘stock figures’. We know, for example, that 1% or 2% of the Earth’s inhabitants own 50% of its assets. And we know that China’s reserves have broadly tripled from s150bn to s450bn over the past five years, whilst South Korean reserves have similarly tripled to some s150bn. Developing countries now hold about 60% of foreign exchange reserves, as measured by the IMF, compared with less than 40% at the start of the 1990s. Such accumulations of capital provide power to governments holding them.

Monetary Geography

For many reasons it would be helpful to know the geography of money: where it resides and where it flows. For instance, knowing the origin and transfers of funds to and amongst Al Queda would have major benefits for security services. Such knowledge could also help governments reduce corporate tax evasion through use of improper transfer pricing. At individual level, knowing where your own money was being spent might change behaviour (see www.globalideasbank.org/site/bank/idea.php?ideaId=5305). Mapping some flows of money is readily possible, as Waldo Tobler demonstrated three decades or so ago when he mapped the ‘money winds’ which ‘blew’ dollar bank notes around the United States. Companies like Visa have excellent analytical tools to help them understand the spending characteristics of their members, including the geography of expenditure, both collective and individual. But isolating capital flow as it moves between different parts of the world is usually difficult and sometimes impossible. This despite the role of technology in facilitating such flow and creating a global pre-eminence of three financial centres: London, New York and Tokyo.

GIS and Globalisation

So what has all this got to do with GIS Such systems have been used to map many individual manifestations of globalisation, such as ‘food miles’, the distance food travels from origin to consumption. As more exotic foods have become part of a normal diet the average distance travelled by food in the UK alone has risen 50% in the last 25 years, increasing congestion and pollution along the way. But unless I am missing something, there has been little other than academic waffle about capital flow and other big drivers of globalisation that are shaping all our lives. And if any tool could prove helpful in understanding the many aspects of globalisation, both the benign and the unpleasant, surely it is GIS?

Value staying current with geomatics?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories to help you learn, grow, and reach your full potential in your field. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired.

Choose your newsletter(s)