Earth Observation Business

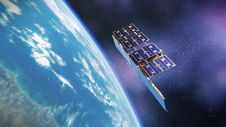

Imaging Earth from space has become normal business and the acquired data a commodity like any other. Earth-observation satellites are constructed and launched at conveyor-belt speed. On 27th October 2005 a Kosmos-3M booster blasted off from Russia’s Plesetsk Cosmodrome carrying, among others, no fewer than two earth-observation satellites: UK’s TopSat (resolution 2.5m) and China’s Bejing-1, carrying black-and-white and colour cameras with resolutions of 4m and 30m, respectively. Japan’s Advanced Land Observing Satellite (ALOS) was rocketed beyond Earth’s atmosphere on 24th January 2006, and the Korean KOMPSAT-2 on 28th July 2006. The Indian Remote Sensing Satellite IRS Cartosat-2 was successfully launched into polar orbit on 10th January 2007. The US GeoEye-1, resolution in the panchromatic band 0.41m and in the multispectral band 1.64m, is scheduled for launch in the third quarter of 2007. To date, over thirty mid- and high-resolution, optical land-imaging satellites and four radar systems are in orbit, involving seventeen countries. If all plans become reality, the number of mid- and high-resolution satellites will double over the coming years and orbiting radar systems will triple, involving 24 countries. Up to 2015, nearly half of launches will be on behalf of Asian Countries; fewer than 10% will be US-based.

Air and Space Survey

Imaging the Earth from space and air has obviously become ubiquitous. How does the market for aerial and spaceborne imagery develop? For which applications is the data used? What are the technological trends? Which software packages are used to process and analyse the images? To answer these questions US-based company Global Marketing Insights, Inc (www.globalinsights.com), specialised in GeoSpatial Technology market research and strategic planning, was contracted by National Oceanic and Atmospheric Administration (NOAA) to conduct a global market survey. The research was carried out in two phases: in 2005 the western market was surveyed and in 2006 the Asian market, including Australia and Russia. The one-year time shift between the two surveys might slightly bias comparison. The 2006 research resulted in 408 completed online survey respondents and fifty interviews. India supplies the largest number of respondents, 17%, next comes Australia, with 10%, and then China, with 7%; Russia is home to 1% of respondents. The report, which compares the two geographical markets, was released February 2007*.

Going into Space

Compared with western countries, Asian professionals are rather young: half of respondents have less than ten years experience in the use and processing of aerial and satellite images, while this is sixteen years in western countries. Asia ranks greater ground resolution as the prime technological impact determining future use of remote-sensing data, while technology integration comes first for western countries. The wish for greater ground resolution probably emerges from restrictions placed by Asian governments on the acquisition of geo-information from the air. Arguing potential security hazards, government departments often enjoy a complete monopoly, while regulations block entry to the market by other providers. The way out is by going into space, but this comes at the cost of reduced ground-sampling distance. Further Asian wishes for the near future are the availability of better processing software and stereo imagery.

Costs

Nearly a quarter of the satellite imagery used in Asia is acquired by western high-resolution satellites: QuickBird (8%), SPOT 5 (6%), Ikonos (5%) and OrbView (3%). However, mid-resolution Landsat imagery is also in frequent demand (13%), probably because this is the only satellite programme to collect and archive four sets of global land images annually while making all its data available to everybody globally for the cost of reproduction. Cost of purchase also determines the more intensive use of raw satellite data in Asia, although this could also be attributed to better craftsmanship. Both in western countries and in Asia, homeland defence and cadastral mapping rank high among government-sector applications currently utilising satellite imagery.

Software

About half the software purchased for processing and analysing aerial and satellite imagery in western countries comes from the ESRI stable, for the government sector this figure is as high as 59%, while in Asia ESRI software accounts on average for a third of purchases, 39% for government. Erdas Imagine ranks second all over the globe, with an average market share of around 22%. Notably, this figure is 12% for the government sector in western countries, slightly higher than MapInfo (11%) but smaller than Auto Desk’s 17%. With a market share of around 12%, ERMapper has a significant presence in Asian countries, while it is absent from the software purchase statistics of western countries.

The Asian remote-sensing industry, keeping pace with overall economic development, is now booming. Asian space programmes may have originated in a sense of national pride, but now the trend is shifting towards adding commercial value to remote-sensing programmes and turning space imagery into an everyday commodity. As it continues to add to home-grown datasets on offer to the rest of the world, the Asian remote-sensing industry holds all the trump cards for global leadership.

*Survey and Analysis of the Asian Remote Sensing Market: Aerial and Spaceborne. www.licensing.noaa.gov/NOAA_AsianRemoteSensing_MarketSurvey.pdf.

Value staying current with geomatics?

Stay on the map with our expertly curated newsletters.

We provide educational insights, industry updates, and inspiring stories to help you learn, grow, and reach your full potential in your field. Don't miss out - subscribe today and ensure you're always informed, educated, and inspired.

Choose your newsletter(s)